-

Donald Trump’s presidential-election victory has fueled major moves in financial markets.

-

Investors are anticipating tax cuts and looser regulation from Trump.

-

Here are five charts that show how Trump’s win has affected markets.

Donald Trump’s election victory immediately sent financial markets into a frenzy.

Stocks soared to records on the prospect of tax cuts and looser regulation. Bank stocks, in particular, got a lift amid speculation of increased deal activity.

Bond yields also surged as investors priced in the expectation that Trump’s protectionist trade policies would be inflationary, which complicates plans for further rate cuts. This led to renewed interest in money-market funds. The dollar rose and gold dipped.

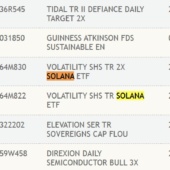

Cryptocurrencies of all sorts charged higher, with bitcoin setting a series of records above $90,000 as traders looked ahead to lighter regulation from the self-appointed “crypto president.”

A group of Bank of America analysts led by Michael Hartnett, the chief investment strategist of BofA Global Research, took stock of the recent moves.

Below are five charts that show just how extreme market fluctuations have been across assets:

Read the original article on Business Insider