With JP Morgan CEO Jamie Dimon warning Washington that China and Russia are seeking to dismantle the Western world, and “World War III has already begun”, access to critical metals that serve as the fuel of America’s military has become the most urgent issue of our time.

Critical metals will determine superpower status and global domination.

China is winning because it controls the bulk of the world’s critical metals, from mining to refining. Washington has been slow to discover domestic or friendly resources, at a time when the U.S. Army desperately needs them.

So, when a North American junior miner emerges as the owner of key critical metals properties in Europe and North America that could provide a new supply of one of these critical metals, the Western world sees hope.

The critical metal that is now poised to make or break a global superpower is antimony, and the miner is Military Metals Corp. (CSE:MILI; OTCQB:MILIF) – a little-known company that just put itself on the critical metals map through some smart strategic acquisitions.

Antimony (Sb), a critical metalloid, is a key element of the American war machine, essential for communication equipment, night vision goggles, explosives, ammunition, nuclear weapons, submarines, warships, optics, laser sighting and more, according to U.S. Army Major General (retired) James Marks.

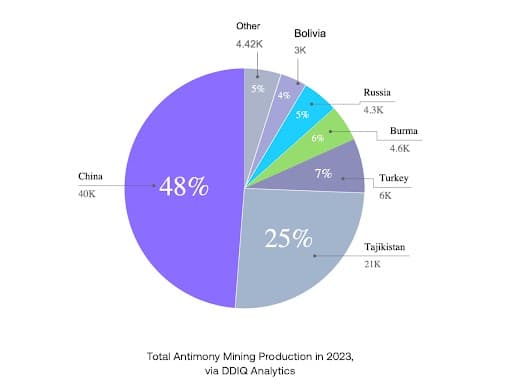

Not only does China control nearly half of the world’s antimony production, but it also cut off antimony exports to the U.S. beginning in September this year.

The U.S. Army is Now Desperate for Antimony

China produces an astonishing ~70% of the world’s rare earth minerals and controls nearly 50% of the global antimony supply.

While China was pushing ahead at full speed, America was napping instead of discovering and developing new critical metals reserves.

Then, at the height of the trade war, China threatened to restrict the export of some rare earth minerals. It made good on that threat this year, and last: First, with Germanium and Gallium in 2023, and then with antimony in September this year.

Now, the U.S. Army has found itself short on an essential element of its military production line, just as war beckons from Europe to the Middle East. And it will need large amounts of antimony to succeed with a new push to ramp up production of artillery shells at newly launched manufacturing facilities after years of destocking.

Meanwhile, American manufacturers use more than 50 million pounds of antimony each year for fireproofing compounds, batteries, ammunition, electronics, specialty glass, and other products, according to MetalTech.

Now, it’s past time for America to stake its claims on critical metals reserves, and Military Metals (CSE:MILI; OTCQB:MILIF) is helping to do just that.

New Antimony Resources for the Coming Critical Demand Surge

Military Metals Corp. is on an antimony acquisition binge that’s taken it as far away as EU-member Slovakia, Nova Scotia in Canada and most recently in the US.

It’s planning to help retell the American antimony story by exploring new and re-developing historical venues that could chip away at China’s control over what is essentially a “military metal”.

Military Metals Corp. recently announced that it has purchased one of Europe’s largest antimony deposits in Slovakia with historical resources. In the heart of Central Europe, it’s a promising Soviet-era resource with an initial discovery from the 1950s and prior development in the ‘80s and ‘90s. It’s already seen two phases of exploration, including drilling and adit excavation.

Source: Military Metals Corp.

At the Trojarova Antimony Project, which could turn Slovakia into a European critical minerals hub, Military Metals Corp. says that underground development of this historical resource, funded by the Slovakian government, was shuttered in the 90s “prior to reaching the richest part of the deposit”.

Back then, with the Cold War winding down, and antimony already having served its purpose as the hero of World War II, the motivation just wasn’t there.

Today, the situation is very different, and EU’S Trojarova project–with a historical resource of over 61,998 tons of antimony worth around $ 2 billion in situ value at today’s spot prices—could now become a military kingmaker.

Figure 1 Military Metals Corp. (CSE:MILI; OTCQB:MILIF):

But Military Metals Corp. isn’t concentrating all of its effects on a single continent: it’s also making huge moves back in North America, in Canada’s famous WWI antimony mine in Nova Scotia.

Military Metals Corp. is sitting on a recently acquired historical antimony/gold play, the West Gore Antimony Project—one of Canada’s biggest past producing antimony mine and a key supplier to the Allied Forces in WWI.

It’s an impressive historical resource, with historical drilling results demonstrating over 7 meters of 10.6 gpt gold and 3.4% antimony.

It’s not stopping there, however.

On October 24th, 2024, the company pounced on another opportunity to further consolidate this territory by signing an LOI to acquire more claims flanking West Gore.

The move to consolidate territory surrounding West Gore—one of the biggest heroes of WWI—is a strategic move that could tie the junior miner directly to North American defense at a time when prices are skyrocketing.

The Antimony Land Rush is a Junior Game

This smart, fast-moving investment strategy could, according to Forbes, be the “latest to generate short-term profits of more than 100% on money invested”.

Forbes was right, even if it underestimated the returns.

Shares in junior mining stocks focused on antimony have surged recently, netting investors up to 800% returns in a very short time.

Australian ASX-listed companies were the first to light up the exchange, with shares in domestic Larvotto Resources Ltd. (ASX:LRV) surging over 800% in the past six months.

The Australian government has placed antimony on its critical metals list, and Australian traders are calling it an “antimony party”.

But compared to its closet peer, Perpetua Resources, Military Metals Corp. appears to have quite a lot of room to run, based on resource estimates and current valuation.

Perpetua is currently valued at around $700 million, with ~90,000 tons of antimony. The U.S. government is in the process of providing a $1.86 billion loan to Perpetua to have their Antimony mine in production by 2029.

Military Metals Corp. is valued at only $23 million right now; but its new play in Slovakia is valued at $2 billion in situ of ore at today’s Antimony spot prices that keeps climbing every week. And that’s only one of its new antimony acquisitions. When you add the potential of West Gore in Nova Scotia, valuations could get even more attractive.

Pricing Power on the Brink of War

Military Metals Corp. CEO Scott Eldridge sees a major antimony supply crunch coming.

He’s certainly not alone.

“An extreme supply shortage since April has led to the sharpest price rally ever recorded in the antimony market since Fastmarkets started pricing the metal back in the early 1980s,” according to the UK’s Minor Metals Trade Association (MMTA).

“The military uses of Sb [antimony] are now the tail that wags the dog. Everyone needs it for armaments so it is better to hang onto it than sell it,” Christopher Ecclestone of London-based Hallgarten & Company recently told the Financial Review, calling it a “sign of the times”.

“This will put a real squeeze on the US and European militaries,” Ecclestone added.

Germany has essentially been demilitarized, with its own defense ministry estimating it has about 2 days of ammunition if there is a war with Russia, which it expects to happen within the next few years at most. Germany and the EU have mandated 2 million artillery shells to be manufactured by the end of 2025 with a investment of 500,000,000 euros.

Indeed, antimony prices have more than tripled since earlier this year from $12,000 per ton to over $38,000.

Two major wars are already involving enemies and allies on four continents, and World War III is already underway for all intents and purposes, making Military Metals Corp.’s (CSE:MILI; OTCQB:MILIF) strategic acquisition binge a fast-moving opportunity that continues to expand with every day that China squeezes supply and America is stuck playing catch-up.

Everyone from the U.S. Department of Defense to their Western counterparts around the world is now scrambling to secure new supply, and China is determined to keep the critical mineral taps turned off as it hoards the metal necessary to shore up U.S. defenses.

Other companies that are worth keeping a close eye on:

Northrop Grumman (NYSE: NOC)

Northrop Grumman is a leading global security company providing innovative systems, products, and solutions in autonomous systems, cyber, C4ISR, space, strike, and logistics and modernization to customers worldwide. With approximately 90,000 employees, Northrop Grumman is a major player in the defense and aerospace industry. The company is known for its expertise in developing cutting-edge technology, including stealth aircraft, unmanned aerial vehicles (UAVs), and missile defense systems. Northrop Grumman is a key partner to the U.S. government and its allies, providing essential capabilities to maintain national security.

Northrop Grumman’s innovative solutions are critical to addressing the evolving threats of the modern world. The company’s work in areas such as cyber security and autonomous systems is helping to shape the future of warfare. Northrop Grumman’s commitment to research and development ensures that its customers have access to the latest technology and capabilities. The company’s global presence also allows it to support its customers around the world.

Northrop Grumman is focused on delivering value to its shareholders through a combination of organic growth and strategic acquisitions. The company is also committed to maintaining a strong balance sheet and returning capital to shareholders through dividends and share repurchases. Northrop Grumman’s financial strength and commitment to shareholder value make it an attractive investment opportunity.

Boeing (NYSE: BA)

Boeing is the world’s largest aerospace company and a leading manufacturer of commercial jetliners, defense, space and security systems, and global services. A major player in the global economy, Boeing employs more than 140,000 people across the United States and in more than 65 countries. Boeing’s products and tailored services include commercial and military aircraft, satellites, weapons, electronic and defense systems, launch systems, advanced information and communication systems, and performance-based logistics and training.

Boeing’s commercial airplane business is one of the company’s most important divisions. Boeing is the world’s leading manufacturer of commercial airplanes, and its products are used by airlines around the world. The company’s defense, space & security business is another key part of Boeing’s operations. This division provides a wide range of products and services to the U.S. government and its allies.

Boeing has faced challenges in recent years, including the grounding of the 737 MAX aircraft and the COVID-19 pandemic. However, the company is committed to overcoming these challenges and continuing to deliver value to its customers and shareholders. Boeing is an iconic American company that plays a vital role in the global aerospace industry.

Rio Tinto (NYSE: RIO)

Rio Tinto, a global leader in the mining and metals sector, is known for its operational efficiency and commitment to sustainable development. The UK-Australian multinational corporation operates in around 35 countries worldwide and has significant assets across several commodities including aluminum, copper, diamonds, coal, iron ore, and uranium. Rio Tinto’s robust portfolio of world-class assets is further reinforced by strong market fundamentals, especially in the copper and iron ore markets, making it an interesting proposition for potential investors.

In addition to its extensive mining operations, Rio Tinto is a leader in the implementation of cutting-edge technologies and sustainable mining practices. The company’s commitment to reducing its carbon footprint and protecting the environment is evident in its various initiatives, such as investments in renewable energy and efforts to rehabilitate mining sites post-extraction. Rio Tinto’s proactive approach to corporate responsibility and sustainability is an integral part of its business strategy, setting a standard for the mining industry.

BHP Group (NYSE:BHP)

BHP Group’s expansive operations encompass a diverse range of mining assets. In Australia, the company operates major iron ore mines in the Pilbara region of Western Australia, which account for a significant portion of global iron ore production. BHP also has copper, coal, and nickel operations in Australia, as well as substantial energy assets, including oil and gas fields. In North and South America, the company has copper and iron ore mines in Chile, Peru, and Colombia, as well as coal operations in the United States. BHP’s global reach and diversified portfolio of commodities allow it to meet the demands of customers around the world and contribute to the global supply of essential resources.

BHP Group is committed to operating in a responsible and sustainable manner. The company recognizes the importance of environmental protection and has implemented various initiatives to reduce its environmental impact. BHP has set ambitious targets to reduce its greenhouse gas emissions and has invested in technologies to improve water usage efficiency. The company also works closely with local communities to minimize the social and environmental impacts of its operations. BHP’s commitment to sustainability has been recognized by various organizations, including the Dow Jones Sustainability Index, which has ranked BHP as a global leader in sustainability for several consecutive years.

BHP Group’s focus on sustainability is not only beneficial for the environment but also aligns with growing consumer and investor demand for ethically sourced and environmentally friendly products. By prioritizing sustainability, BHP is positioning itself as a leader in the mining industry and demonstrating its commitment to long-term value creation for its stakeholders. The company’s commitment to sustainability is a key differentiator and a source of competitive advantage in an industry that is increasingly focused on environmental and social responsibility.

Albemarle Corporation (NYSE:ALB)

Albemarle is a global specialty chemicals company headquartered in Charlotte, North Carolina. The company operates in three segments: Lithium, Bromine Specialties, and Catalysts. Albemarle is the world’s largest producer of lithium, a key component in electric vehicle batteries. The company also produces a variety of other specialty chemicals, including bromine, catalysts, and pharmaceuticals.

Albemarle was founded in 1887 as the Albemarle Paper Manufacturing Company. The company initially produced paper and pulp, but it diversified into other chemicals in the 1960s. In 1994, Albemarle merged with Ethyl Corporation, a producer of specialty chemicals. The combined company was renamed Albemarle Corporation.

In recent years, Albemarle has benefited from the growing demand for lithium-ion batteries. The company has invested heavily in expanding its lithium production capacity. In 2021, Albemarle announced plans to invest $500 million in a new lithium hydroxide plant in North Carolina. The plant is expected to be operational in 2025. Albemarle is also exploring other opportunities to expand its lithium business, including potential acquisitions.

L3Harris Technologies (NYSE: LHX)

L3Harris Technologies is an agile global aerospace and defense technology innovator, delivering end-to-end solutions that meet customers’ mission-critical needs. The company provides advanced defense and commercial technologies across space, air, land, sea, and cyber domains. L3Harris has approximately 48,000 employees and customers in more than 100 countries.

L3Harris Technologies is a leading provider of a wide range of products and services, including avionics, communication systems, electronic warfare systems, night vision devices, and tactical radios. The company’s products are used by customers in the defense, aerospace, and government sectors. L3Harris is committed to providing its customers with innovative and reliable solutions that meet their evolving needs.

L3Harris Technologies was formed in 2019 through the merger of L3 Technologies and Harris Corporation. The merger created a leading global defense technology company with a broad portfolio of products and services. L3Harris is committed to growth and innovation, and the company is well-positioned to succeed in the rapidly changing aerospace and defense industry.

Parsons Corporation (NYSE: PSN)

Parsons is a leading provider of solutions for critical infrastructure. The company’s expertise in areas such as cybersecurity, missile defense, and space is helping to protect national security and critical infrastructure around the world. Parsons is also a leader in the development of smart cities and connected infrastructure.

Parsons faces challenges such as competition from other large engineering and construction firms. The company must continue to innovate and develop new solutions to maintain its competitive edge.

Despite these challenges, Parsons is well-positioned for future growth.

The company’s strong track record, diverse portfolio of services, and commitment to innovation make it a valuable partner to governments and businesses around the world.

Energy Fuels (NYSE American: UUUU)

Energy Fuels is a leading U.S.-based uranium mining company, operating the only conventional uranium mill in the United States. They have a diverse portfolio of uranium mines and projects in key uranium districts across the Western U.S. Energy Fuels also produces vanadium, a metal used in high-strength steel alloys and aerospace applications.

This company matters because they are a crucial player in the U.S. nuclear fuel cycle. Uranium is the primary fuel for nuclear power plants, which provide a significant portion of the nation’s electricity. A secure and reliable domestic supply of uranium is essential for maintaining the operation of these power plants, ensuring energy security, and reducing reliance on foreign sources of nuclear fuel.

Furthermore, Energy Fuels’ role in the U.S. uranium industry is important for national security, as uranium is also a critical component in nuclear weapons. While the U.S. currently has a stockpile of uranium, maintaining a domestic uranium mining and processing capability is crucial for ensuring the long-term viability of the nation’s nuclear deterrent and reducing dependence on foreign sources of this strategically important material.

Neo Performance Materials (TSX: NEO)

Neo Performance Materials is a leading global company engaged in the production and processing of advanced industrial materials, with a focus on rare earth and rare metal-based functional materials. They operate in three main segments: Magnequench, Chemicals & Oxides, and Rare Metals. Magnequench produces magnetic powders used in high-performance magnets for applications such as electric vehicles and wind turbines. Chemicals & Oxides manufactures and distributes advanced industrial materials for various uses, including catalysts, electronics, and water treatment. Rare Metals focuses on the production of specialty metals like tantalum, niobium, and gallium, which are critical for aerospace, defense, and electronics applications.

Neo Performance Materials plays a vital role in supporting national security by providing essential materials for defense and high-tech industries. Their expertise in rare earth and rare metal processing contributes to the development and production of advanced technologies used in defense applications, such as guidance systems, lasers, and communication equipment. By ensuring a reliable supply of these critical materials, Neo Performance Materials helps to strengthen the resilience of the defense industrial base and reduce reliance on foreign sources.

Aclara Resources (TSX: ARA)

Aclara Resources is a development-stage rare earth mineral resource company focused on its Penco Module project in Chile. This project has the potential to be a significant source of heavy rare earth elements, which are critical for various high-tech applications, including permanent magnets used in electric vehicles, wind turbines, and defense technologies. Aclara is committed to developing the Penco Module project in a sustainable and environmentally responsible manner, using a unique ionic clay adsorption process that minimizes environmental impact.

Aclara Resources contributes to national security by diversifying the global supply of heavy rare earth elements. These elements are essential for the production of advanced technologies used in defense applications, such as guidance systems, lasers, and communication equipment. By developing a new source of these critical minerals outside of China, which currently dominates the rare earth market, Aclara Resources helps to reduce reliance on a single supplier and strengthen the resilience of the defense industrial base.

By. James Stafford

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. The forward-looking statements in this publication are based on current expectations and assumptions about future events, geopolitical developments, trade policies, market conditions, the company’s strategic initiatives to address the critical shortage of antimony, and current expectations, estimates, and projections about the industry and markets in which the company operates. Factors that could change or prevent these statements from coming to fruition include, but are not limited to, the potential impact of the upcoming U.S. elections on various industries and specific companies, changes in government policies, market conditions, regulatory developments, geopolitical events and the company’s ability to successfully acquire and develop new antimony resources and fluctuations in antimony prices. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by the companies mentioned in this article but may in the future be compensated to conduct investor awareness advertising and marketing. While the opinions expressed in this article are based on information believed to be accurate and reliable, such information in our communications and on our website has not been independently verified and is not guaranteed to be correct. The content of this article is based solely on our opinions which are based on very limited analysis, and we are not professional analysts or advisors.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of the companies featured in this article and therefore has an incentive to see the featured companies’ stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of the featured companies in the market. The owner of Oilprice.com will be buying and selling shares of the featured companies for its own profit and may take this opportunity to liquidate a portion of its position. Accordingly, our views and opinions in this article are subject to bias, and why we stress that you should conduct your own extensive due diligence regarding the featured companies as well as seek the advice of your professional financial advisor or a registered broker-dealer before you consider investing in any securities of the featured companies or otherwise.

NOT AN INVESTMENT ADVISOR. Oilprice.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. You should not treat any opinion expressed herein as an inducement to make a particular investment or to follow a particular strategy, but only as an expression of opinion. The opinions expressed herein do not consider the suitability of any investment with your particular objectives or risk tolerance. Investments or strategies mentioned in this article and on our website may not be suitable for you and are not intended as recommendations.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making any investment. This communication should not be used as a basis for making any investment in any securities. Past performance is not indicative of future results.

RISK OF INVESTING. Investing is inherently risky. Do not trade with money you cannot afford to lose. There is a real risk of loss (including total loss of investment) in following any strategy or investment discussed in this article or on our website. This is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote in any jurisdiction. No representation is being made as to the future price of securities mentioned herein, or that any stock acquisition will or is likely to achieve profits.