Bitcoin Options ETF is reportedly set to commence trading today, sparking optimism in the broader crypto market. Notably, the anticipated approval has also bolstered market sentiment over a potential BTC rally to $200K in the coming days. Besides, it also comes as the US Spot Bitcoin ETF has regained momentum, starting the ongoing week with a strong influx, indicating growing institutional interest in the digital assets space.

Bitcoin Options ETF Set To Start Trading Today

A recent report by Bloomberg said that Nasdaq Inc. is planning to allow options trading on BlackRock Inc’s BTC ETF today. The Bitcoin Options ETF approval would enable traders to leverage derivatives to bet on or against the top crypto by market cap.

This move has sparked optimism in the broader market, especially after the success and soaring interest in the US Spot Bitcoin ETF. According to Farside Investors data, the US Spot Bitcoin ETF noted an influx of $254.8 million on November 18, after noting outflow for the two consecutive days last week.

Notably, in a Monday Bloomberg’s ETF IQ, Nasdaq ETP Listings head Alison Hennessy said that the firm plans to list and commence trading of the options ETP as soon as “tomorrow”. Besides, she also showed confidence towards gaining significant attention from the traders once these “options listed on IBIT.”

In addition, another Nasdaq spokesperson also confirmed the launch today. It’s also worth noting that this development comes just after the US Commodity and Futures Trading Commission (CFTC) recently green light the BTC Options ETF, which has sparked market discussions.

Meanwhile, the BTC has noted a strong rally over the past few days, touching a new ATH, after Donald Trump’s election win. The anticipation over a clear regulatory path for the digital assets space and pro-crypto policies in the US after the Republican victory has fueled market sentiment. Having said that, a flurry of investors anticipates the rally will continue in the coming days.

BTC To Hit $200K?

BTC price today traded near the flatline at $91,800, while its one-day trading volume jumped 52% to $73.59 billion. The flagship crypto has touched a 24-hour high of $92,596 while noting a monthly gain of 34%. Besides, BTC Futures Open Interest rose more than 1.5% during writing, indicating a strong market confidence towards the crypto.

Amid this, the optimism over a potential Bitcoin Options ETF launch in the US has further fueled market sentiment. Besides, in a recent report, BCA Research predicts Bitcoin price to hit $200K as the crypto nears the $100K mark.

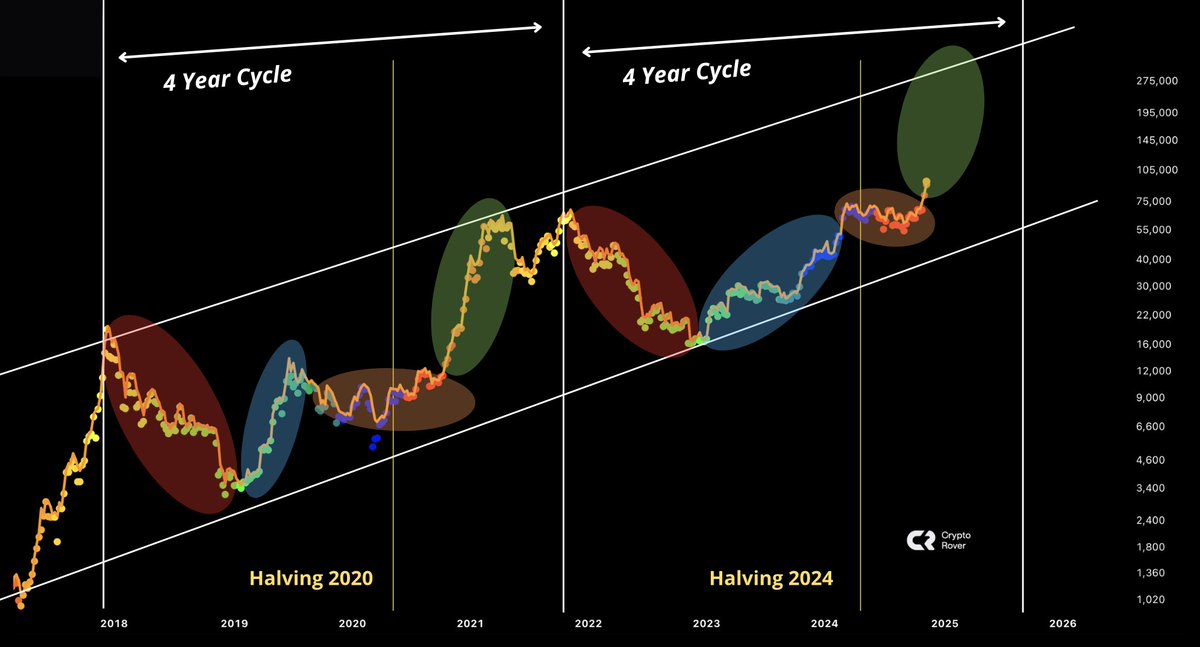

Simultaneously, prominent crypto market expert Ali Martinez has also shared a bullish prediction for BTC recently. In a recent X post, Martinez highlighted the historical trends of BTC, saying that if the crypto follows the previous cycles, it is poised to hit $150K next.

Echoing the same sentiment, another crypto market analyst Crypto Rover also shared a similar chart for BTC, predicting the crypto to soar past the $200K mark. In addition, Fundstrat Head of Research Tom Lee also predicts that the crypto is poised to continue its rally in the coming days, further fueling market interest.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: