Two economies headed in opposite directions

Article content

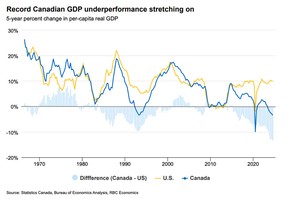

Canada’s economy has been falling behind the United States — in fact, most major economies — for some time now, but the election of Donald Trump threatens to widen that record gap even further, say economists.

Just how big is the gap? In 2023, real gross domestic product per capita in the U.S. was 43 per cent higher than in Canada, according to Trevor Tombe, an economics professor at the University of Calgary. This year he estimates that gap will widen to almost 50 per cent — “This stunning divergence is unprecedented in modern history.”

Advertisement 2

Article content

Since Trump was elected, economists have been changing their forecasts for both sides of the border.

Though the actual impact of the new president’s policies remain uncertain, it’s a safe bet that they will boost both GDP and inflation in the near term in the U.S.

Canada, on the other hand, will feel the sting of some of these policies. Royal Bank of Canada economists do not expect America’s northern neighbour will be a direct target of trade disruption, but tariffs Trump has promised on imports from China, Mexico and other parts of the world will have “negative spillover effects on Canada.”

Corporate tax cuts in the United States would also reduce Canada’s competitiveness, said RBC economists Nathan Janzen and Claire Fan.

There are other headwinds at home.

Ottawa’s plan to slash immigration targets will ease housing shortages, but it will also slow GDP growth, “accelerate population aging, and add to a growing government funding gap for public services like healthcare,” said RBC.

Add to this the wave of mortgage renewals at higher interest rates that will squeeze household budgets over the next two years, and the economists at Desjardins Group have revised their outlook for the Canadian economy “meaningfully lower starting in 2026.”

Article content

Advertisement 3

Article content

Desjardins estimates Canada’s real GDP could be as much as 1.7 per cent lower by the end of 2028 with Trump in the White House. “While a recession may be narrowly avoided, it can’t be ruled out,” they said in a note before the election.

The record gap in growth between the two countries will also widen the gap between policy rates of the Federal Reserve and the Bank of Canada, said RBC.

A stronger U.S. economy and hotter inflation means the Fed will need to keep rates higher than they otherwise would have and Canada’s softer economy will pressure our central bank to cut its rate lower, they said.

RBC expects the Bank of Canada will cut its rate to 2 per cent by the end of 2025, while the Fed stops at 4 to 4.25 per cent.

Sign up here to get Posthaste delivered straight to your inbox.

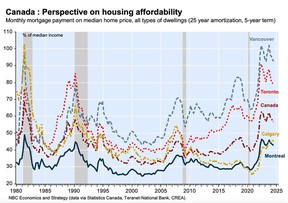

Housing affordability improved in Canada for the third straight quarter as mortgage rates fell and incomes rose, says National Bank of Canada.

Affordability was up in nine of Canada’s 10 biggest markets, with only Quebec showing a decline. Vancouver, Toronto, Victoria showed the biggest improvements, followed by Hamilton, Ottawa-Gatineau, Calgary, Montreal, Winnipeg and Edmonton.

Advertisement 4

Article content

Since their peak at the end of 2023, financing costs have fall by 63 basis points to their lowest level since the second quarter of 2022, says National.

Despite this, mortgage payments as a percentage of income remain well above historical levels and “the recent rise in 5-year government bond yields since September could mean that the brightening may be short-lived,” said the economists.

- Today’s Data: United States producer price index

- Earnings: CI Financial Group, Brookfield Corp., Walt Disney Co.

If you are a millennial who feels shut out of Canada’s housing market, don’t get mad, get rich. That’s the message from Kristy Shen, who decided early on to pass on the mortgage and seek financial independence instead. At 32, she and her husband managed to retire with $1 million in savings and travelled the world. Find out how she did it.

Hard earned truths

In an ongoing series about what the next generation needs to know to build wealth, we offer Hard Earned Truth #6: Meme stocks won’t make you rich. So what does work for long-term wealth building? Read on.

Advertisement 5

Article content

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Article content