U.Today – The cryptocurrency has recently surged to remarkable new heights, and now its RSI (Relative Strength Index) is displaying a flattening effect at the top. This pattern is comparable to a double-top pattern in conventional RSI analysis, in which the RSI reaches comparable high levels, twice forming a ceiling of sorts.

Double tops frequently indicate a possible reversal on conventional price charts, but in the case of RSI they might actually reinforce the notion of trend continuation rather than reversal. The fact that ‘s RSI is currently in the 70-80 range indicates that the asset is slightly overbought but still holding firm. Historically prolonged bullish periods rather than abrupt declines have frequently accompanied Bitcoin’s RSI rising above 70. Strong buying momentum is indicated by the fact that it is holding at this level without experiencing a significant correction.

Recently, Bitcoin has surpassed $75,000, a crucial psychological and technical barrier and broken above important resistance levels. Bitcoin has been following an upward trend from a price standpoint, and the current price action indicates strong support. Bitcoin has a good chance of continuing to gain ground as long as it remains above $70,000. In line with prior consolidation areas, $69,000 is one of the support levels to keep an eye on. Fortunately, if Bitcoin maintains its current trend, it may reach $78,000 and even higher.

The noteworthy volume that has accompanied this movement has further reinforced the bullish sentiment. As was recently observed, a high-volume breakout usually signals real interest rather than a passing pump. Any variations in volume trends should be watched by investors as an indication of shifting sentiment.

‘s price recovers

With prices rising noticeably in recent days, Cardano is finally seeing a noticeable uptick in value. ADA has demonstrated such strong growth for the first time since February, breaking through multiple resistance levels and attracting investor attention. The spike occurs as bullish sentiment surrounding the asset has been reinforced by ADA’s move above the $0.40 mark, which saw it gain about 6% on the day.

The ability of ADA to overcome the $0.35-$0.36 resistance zone, which had served as a recalcitrant barrier for months, is a major factor driving this rally. ADA was able to test higher levels after breaking through this zone, and this movement has strong support due to volume spiking.

Investor confidence is also probably boosted by Cardano’s network advancements and growing ecosystem. ADA has technically broken above its 50-, 100- and 200-day moving averages indicating the possibility of a long-term upward trend. After recent improvements in macroeconomic sentiment, major assets are gaining traction, and the current price action is in line with these broader market trends. But it is important to approach this expansion with a healthy dose of optimism.

Although ADA is displaying positive indicators, the asset may be approaching overbought territory as its Relative Strength Index (RSI) has surpassed 70. This might result in a brief decline, providing investors with a chance to consolidate their gains prior to a possible uptrend continuation.

ADA may try to test the next significant resistance level, which is located around $0.50, if it can keep support above $0.40 and continue its upward trajectory. A decline below $0.40, however, might trigger a retest of support in the $0.35 range. ADA may finally be in the early phases of a wider recovery trend, based on Cardano’s price action, which is currently a positive development.

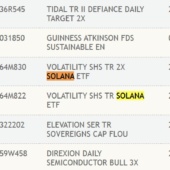

is back

The psychological barrier of $200 has been surpassed by Solana (SOL) which, if momentum continues, could pave the way for an all-time high. A major accomplishment for the blockchain platform, which has witnessed a spike in network activity and popularity, particularly in the meme coin industry, this recent milestone signals renewed bullish sentiment. A surge in on-chain activity is driving Solana’s current rally by drawing more users and projects to the platform.

The flourishing DeFi ecosystem, where SOL’s quick transactions and affordable fees make it a desirable substitute for other networks, also supports this expansion. There is a growing demand for SOL, which supports its price increase as more users interact with applications’ NFTs and tokens on Solana as the platform grows. Technically speaking, catching $200 creates a strong basis for future upward movement.

SOL may aim for its all-time high of about $260 if it breaks through the next significant resistance level, which is located around $216. Maintaining this price could stimulate additional buying pressure and help the asset continue its upward trend. The $200 level currently serves as a support.

The strength of this rally is also reflected in the Relative Strength Index (RSI), which has remained above the 70 mark, which generally denotes strong buying interest. High RSI values, however, should alert investors to any indications of overextension. In order to keep SOL moving forward, steady volume growth and ongoing network activity will be essential.