Litecoin price rose to $82.69 on Tuesday, November 12 as the rally in the crypto industry continued. It then pulled back and was trading at $76 at press time as the recent surge took a breather. This article explains what needs to happen for the LTC price to jump to $100.

Litecoin Price Needs To Flip Key Resistance To Hit $100

Litecoin, like most cryptocurrencies, has jumped in the past few months, moving from a low of $50 in July to over $76. The recent surge was mostly because of the recent Donald Trump victory, and the ongoing interest rate cuts by top central banks like the Federal Reserve, Bank of England, and European Central Bank.

Litecoin price, however, has found a strong resistance at $82.68, which coincided with the upper side of the ascending channel. At the same time, it has formed a bearish engulfing pattern, which happens when a big bearish candlestick follows and completely covers a green one.

The bearish engulfing candlestick will be confirmed if the LTC price ends the day below $74.5, the lower side of Monday’s candlestick. If this happens, the coin will likely continue falling, with the next target being the lower side of the channel at $68.66.

For Litecoin price to hit $100, which is 33% above the current level, it needs to first rise above Tuesday’s high of $82.70. That is an important level since it also coincides with the upper side of the ascending channel.

Additionally, the 50-day and 200-day moving averages need to cross each other, forming a golden cross. Finally, Bitcoin needs to bounce back above $90,000, which will lead to more gains among altcoins.

LTC Price Has More Catalysts

LTC price has more catalysts that could push it higher in the near term. According to IntoTheBlock, the balances held by short-term holders have started rising and are up by over 31% in the last 30 days. In most cases, these increases are usually seen positively and usually happen ahead of a major bull run.

Litecoin’s hash rate, which measures a proof-of-work’s network health has also jumped to 1.38 PH/s, its highest level since November 8. Its mining difficulty has also jumped to 46.5 million, its highest level on record.

More data shared by Litecoin’s developers show that LTC has been the number one crypto choice for payments. The report showed that it had a 33% market share followed by Bitcoin and Etherem, which have a 27% and 11% share, respectively.

Frequently Asked Questions (FAQs)

The coin needs to invalidate the bearish engulfing pattern, form a golden cross, and close above this week’s high. Also, Bitcoin needs to resume its uptrend, which will lead to more altcoin gains.

Litecoin’s all-time high is $413, which it hit in 2021. For it to retest that level, it needs to jump by 460% from the current level. While this is possible, it will likely take time to happen.

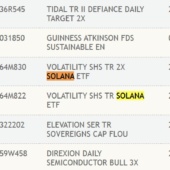

Bitcoin has been a better investment than Litecoin over time because it is a more popular asset. It is also seeing substantial ETF inflows.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: