Almost 90% of renters believe it’s out of reach for them, survey finds

Article content

Canada’s housing market is so grim that a majority of people now believe owning their own home is a “luxury.”

Eighty-four per cent of those surveyed by Habitat for Humanity agreed with the national affordable housing organization that buying a home “feels like a luxury,” while 88 per cent of renters said that they feel homeownership “has become out of reach.”

Advertisement 2

Article content

It’s a sentiment not confined to one specific group, with 82 per cent of baby boomers, 86 per cent of generation X, 87 per cent of millennials and 84 per cent of generation Z agreeing that buying a home is a luxury.

Canada’s housing crisis is also spawning far-reaching tentacles of hardship across society and in younger generations, the third annual Affordable Housing Survey said.

For example, 82 per cent of people worry the lack of housing affordability coupled with high home prices are adversely affecting their mental health and well-being; 78 per cent said people’s inability to buy a home is exacerbating the wealth gap; and 66 per cent of gen-Zers have thought about delaying starting a family because of a lack of appropriate housing.

“Canadians are sending a clear message: the housing crisis is no longer just about housing,” Pedro Barata, chief executive of Habitat for Humanity Canada, said in a release. “This is particularly evident for young Canadians, who are rethinking or delaying major life decisions to achieve homeownership, signalling a deep and lasting impact on future generations and society as a whole.”

Article content

Advertisement 3

Article content

Home prices are daunting.

The median price for a home based on a composite of Canada’s 10 major cities was $795,540 in the third quarter, National Bank of Canada said in a report released earlier this week, with mortgage payments eating up 56.6 per cent of income on a down payment of roughly seven per cent.

But, owning a home seems to be key to financial security, according to data released by Statistics Canada in October.

The survey of financial security for 2023 said families who owned their principal residence, but did not have an employer-sponsored pension plan had a median net worth of $914,000, while families with an employer pension plan, but did not own their principal residence had a median net worth of $359,000.

Younger families — those whose main income earner is under 35 — who owned a home saw their median net worth increase 220 per cent to $457,100 in 2023 from $142,800 in 2019. The median net worth of people in the same age group who did not own a home only increased 65 per cent to $44,000 from $26,700 in the same timeframe.

Given these figures, those surveyed by Habitat for Humanity said they are worried Canada’s middle class is under attack. Only 58 per cent believe the country still has a middle class, while about eight in 10 people are “worried the lack of affordable housing is contributing to shrinking the middle class.”

Advertisement 4

Article content

As people hunt for housing, a greying Canada could be sacrificing its much-needed younger generations.

Habitat for Humanity said 44 per cent of gen-Zers and 40 per cent of millennials said the intractable housing market meant they had to move to a more affordable area resulting in fewer job opportunities. Almost one-third of millennials and one quarter of gen-Zers said they would consider relocating to another country to find affordable housing.

Even though owning a home has become a struggle for many, people don’t want to give up on it as a goal, with 87 per cent saying it can create more stability in life, while 86 per cent said it strengthens a person’s financial future and 81 per cent said it provides a better future for children.

“Despite homeownership being out of reach for so many, Canadians continue to believe in its benefits,” Barata said. “Homeownership can’t just be the privilege of the wealthy or lucky few.”

Sign up here to get Posthaste delivered straight to your inbox.

Burdened with growing financial pressures, including the cost-of-living, it comes as little surprise that less than half of Canadians feel they’re saving enough money to meet their financial goals.

Advertisement 5

Article content

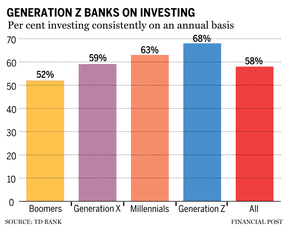

But there is a wave of younger Canadians investing early in order to get ahead.

A large majority — 68 per cent — of generation Z respondents in a survey from Toronto-Dominion (TD) Bank, released Thursday, said they have regularly invested funds (at least once a year), the highest of any age demographic. In comparison, only 58 per cent of all respondents said the same, and about a third of Canadians have never invested at all. — Serah Louis, Financial Post

- Canadian Real Estate Association releases existing home sales for October.

- Today’s data: Statistics Canada releases manufacturing sales and wholesale sales excluding petroleum for October. U.S. retail sales for October, industrial production and capacity utilization for October.

- Earnings: First Helium Inc., Organigram Holdings Inc., Telesat Canada, A&W Food Services of Canada Inc.

Advertisement 6

Article content

Recommended from Editorial

Sometimes, investors will pass on a stock because they think it’s too expensive on valuation or has gone up too much. Investing expert Peter Hodson believes that thinking in those terms is the wrong way to go. Instead, he suggests approaching these high-flying equities from a different angle. Read Hodson here to find out more.

Hard Earned Truths

In an ongoing series about what the next generation needs to know to build wealth, we offer Hard Earned Truth #7: The pros can’t pick stocks and neither can you. So, what should an investor do? Read on.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Financial Post on YouTube

Visit Financial Post’s YouTube channel for interviews with Canada’s leading experts in economics, housing, the energy sector and more.

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content