Super Micro Computer hired a new auditor Monday after its previous one, Ernst & Young, quit in the middle of an engagement.

The Silicon Valley-based company, which touts a close relationship with AI stock-rocket Nvidia, had risked being delisted from the Nasdaq after failing to file both an annual and quarterly report on time. Its previous grace period with the exchange would have run out next week.

But after hiring BDO, Super Micro submitted a plan to Nasdaq to comply with exchange-listing rules and issue audited financials.

A spokesperson from Super Micro told Fortune in a statement: “As we previously disclosed, Supermicro intends to take all necessary steps to achieve compliance with the Nasdaq continued listing requirements as soon as possible.”

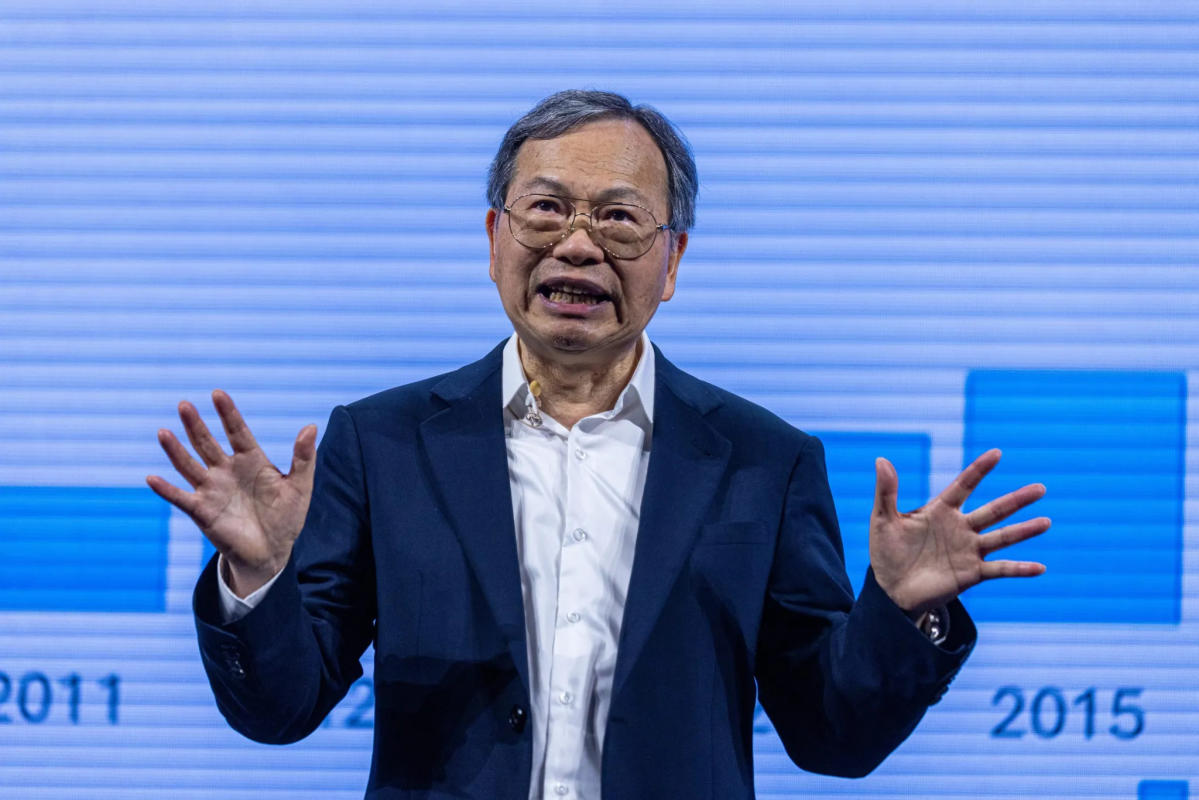

In a statement, Super Micro CEO Charles Liang welcomed its new auditor, BDO USA, on Monday. “BDO is a highly respected accounting firm with global capabilities,” said Liang. “This is an important next step to bring our financial statements current, an effort we are pursuing with both diligence and urgency.”

That comes after a blistering resignation letter from its former auditor last month.

EY wrote that it was no longer able to rely on management and the board’s audit committee, which is supposed to be made up of independent directors who oversee the company for the benefit of shareholders.

This isn’t Super Micro’s first rodeo. The company was delisted in 2018 before rejoining the tech-heavy Nasdaq stock exchange in 2020, where it soared 3,000% and eventually joined the Fortune 500.

Before it paused on issuing audited financial statements, its previous annual report showed gross profit margins had risen to 18% in fiscal 2023, compared to 15.4% in fiscal 2022, but it faced significant challenges. The value of its inventory was $1.45 billion in 2023, and it had to increase its inventory reserves by $36.6 million. In a bleeding-edge competitive industry, the risk that some of its inventory will be obsolete looms large.

BDO and Nasdaq did not immediately respond to a request for comment. An Nvidia spokesperson told Fortune the company is in a quiet period ahead of earnings and declined to comment.

This story was originally featured on Fortune.com