Former US President and Republican presidential candidate Donald Trump gestures as he speaks during a campaign rally at Van Andel Arena in Grand Rapids, Michigan on November 5, 2024.

Kamil Krzaczynski | AFP | Getty Images

Shares of Trump Media & Technology slid on Tuesday, marking the end of a volatile trading day as Americans head to the polls.

Shares trade under the ticker DJT — former President Donald Trump‘s initials — and are seen as a possible proxy for the Republican candidate’s prospects of retaking the White House.

Shares finished down around 1.2% after being halted during the session for volatility. Tuesday’s rocky trading day marked the latest in what’s been a series of major swings over recent weeks.

The stock climbed as much as 15% at session highs. Action in Trump Media was heavy, with the volume coming in at more than 147 million shares — well above the 30-day average of 52.1 million.

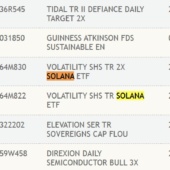

DJT 1-day chart

To be sure, the stock is not necessarily a pure play on whether Trump wins. The stock is up a lot already this year and could be influenced by other factors, such as profit taking.

Indeed, Trump Media, which is majority-owned by Trump, has jumped more than 90% in 2024. But the stock has struggled recently as Vice President Kamala Harris appeared to gain momentum heading into Election Day. Shares have plummeted more than 34% over the past week despite a 12% jump on Monday.

“We are trading this like GameStop on steroids right now,” Jay Woods, chief global strategist at Freedom Capital Markets, said on CNBC Monday.

“And you know, kudos to those that are trading it making money. But over the long term, the metrics don’t make any sense,” Woods added.

Trump Media shares have seen huge retail trader inflows in the week’s leading up to the election. It has also been the most-discussed stock on Reddit page WallStreetBets, which gained popularity during the GameStop fueled stock meme fad of 2021.

Though the stock has been viewed as a way to invest behind a Trump victory, the election is considered neck-and-neck as Americans head to the polls on Tuesday.

— With reporting by Kevin Breuninger.

Correction: Jay Woods is chief global strategist at Freedom Capital Markets. An earlier version misstated his title.