It would cost $103 billion to replace infrastructure that’s already in ‘very poor’ condition

Article content

Canadians are growing increasingly pessimistic about the state of Canada’s infrastructure even as it tries to greatly expand its housing capacity.

Just 31 per cent believe the current state of infrastructure in their communities — including roads, hospitals, wastewater systems and community centres, among other assets — is in good or excellent condition, according to a new survey by the Canadian Council for Public-Private Partnerships (CCPPP), and 88 per cent are very pessimistic about the future of Canada’s infrastructure.

Advertisement 2

Article content

“Canadians clearly see trouble on the horizon for our country’s infrastructure,” CCPPP chief executive Lisa Mitchell said in a news release. “Still suffering from the effects of inflation and its daily hits on their household budgets, they’re also open to governments taking a more pragmatic approach to this challenge.”

It will cost $103 billion to replace the transportation and water infrastructure that’s already in “very poor” condition and another $254 billion to replace the infrastructure in “poor” condition, according to Statistics Canada’s recent Canada’s Core Public Infrastructure Survey.

Overall, the agency estimates it will cost $1.16 trillion to replace all of the country’s road-related assets, regardless of condition.

Paying for these upgrades is a major concern, and 63 per cent of those surveyed don’t believe the Canadian government can afford them without raising taxes, while 49 per cent would support public-private partnerships (P3) to help mitigate the costs.

“There is broad support across all regions, demographics and political parties for governments to partner with the private sector to help shoulder the load and share these financial costs and risks,” Mitchell said.

Article content

Advertisement 3

Article content

“We cannot bridge this country’s infrastructure gap, improve the lives of Canadians or grow our economy without the public and private sectors working together to find solutions.”

Canada is trying to dramatically ramp up housing construction to boost supply and ease housing prices.

The 2024 federal budget included a plan to build 3.87 million new homes by 2031, including a $4-billion housing accelerator fund and a $40-billion program for apartment construction loans.

But with massive housing ambitions come the need for new roadways and water systems. The survey said that 92 per cent of Canadians believe the growing population will increase the demand for new infrastructure.

A spokesperson for Housing, Infrastructure and Communities Canada did not provide a comment by deadline.

Sign up here to get Posthaste delivered straight to your inbox.

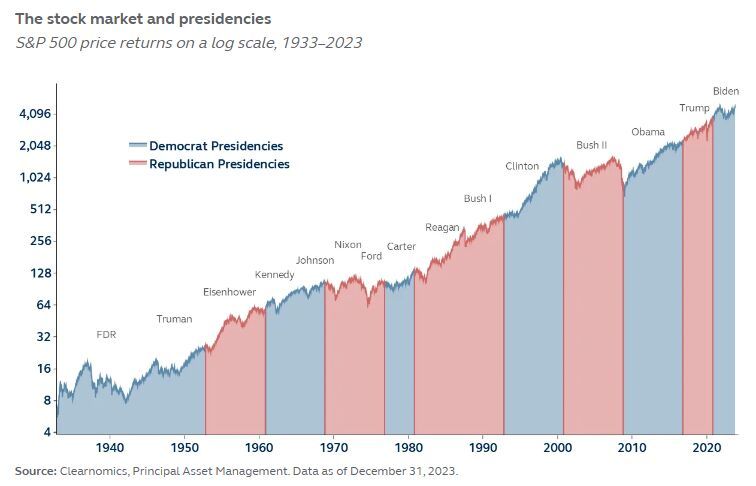

While analysts predict stock volatility this week due the tight U.S. election, they also note that elections have little impact on the long-term outlook of the stock market.

The S&P 500 has risen nine of the last 11 election days, with a median return of 0.8 per cent, but with the race so close some experts believe the market could swing as much as 1.8 per cent on Wednesday.

Advertisement 4

Article content

Whatever happens with the election, there’s little reason to believe a significant drop in the markets is on the way, with Goldman Sachs analysts predicting just an 19 per cent chance of a bear market in the next 12 months.

- Donald Trump defeats Kamala Harris in the United States presidential election

- Bank of Canada senior deputy governor Carolyn Rogers speaks at the Economic Club of Canada event on the mortgage market.

- Earnings: Manulife Financial Corp., Great-West Lifeco Inc., Nutrien Ltd., Brookfield Infrastructure Partners LP, Lyft Inc.

Recommended from Editorial

With the federal government’s proposed changes to the capital gains inclusion rate not yet passed into law, there are plenty of ways Canadians affected by the changes can prepare for it. The Canada Revenue Agency is encouraging taxpayers to be ahead of the ball and file taxes as if the bill is passed and will need an amended return in the event it never passes.

Advertisement 5

Article content

Hard earned truths

In an ongoing series about what the next generation needs to know to build wealth, we offer hard earned truth #5: One stock can ruin your returns. Whether you own a few high flyers that can crash unexpectedly, or you miss out on big winners, a small number of stocks can drive a big part of market gains or losses.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Ben Cousins, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Article content