Article content

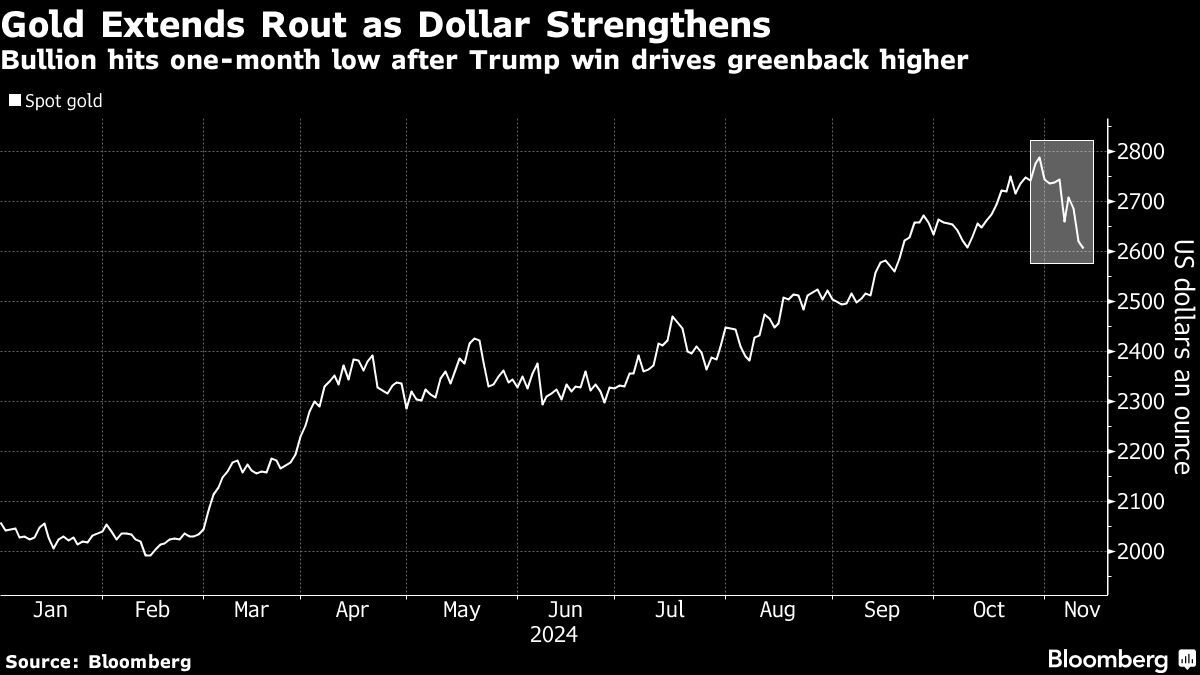

Gold slipped to its lowest level in more than seven weeks as the U.S. dollar continued to strengthen following Donald Trump’s election victory.

Bullion fell as much as 1.1 per cent — after sliding 2.5 per cent in the previous session — as a gauge of the dollar rose to its highest level in a year. The gains, which make commodities priced in the greenback more expensive for most buyers, are linked to Trump’s pledges to cut taxes and impose trade tariffs.

Article content

The precious metal has declined more than five per cent since last week’s election, as hedge funds unwound bullish wagers and exchange-traded fund flows turned less supportive amid a widespread rotation into U.S. equities. The sell-down is also “partly technical” after a break below the 50-day moving average led funds to exit long positions, according to Pepperstone Group Ltd. Head of Research Chris Weston.

Bullion is still up more than 25 per cent this year, supported by the United States Federal Reserve’s easing cycle, central bank purchases and heightened geopolitical and economic risks that drove haven demand.

Investors will look to Wednesday’s core consumer price index report, which excludes food and energy, for clues on the Fed’s next steps after the U.S. central bank cut rates by 25 basis points last week. Many economists see the potential inflationary impact of Trump’s policies leading to fewer rate cuts than previously expected. Lower borrowing costs tend to benefit gold, which doesn’t pay interest.

Recommended from Editorial

Spot gold declined 0.7 per cent to US$2,599.40 an ounce as of 11:25 a.m. in New York. The Bloomberg Dollar Spot Index rallied for a third consecutive day. Silver, palladium and platinum all fell.

With assistance from William Clowes and Yvonne Yue Li

Share this article in your social network