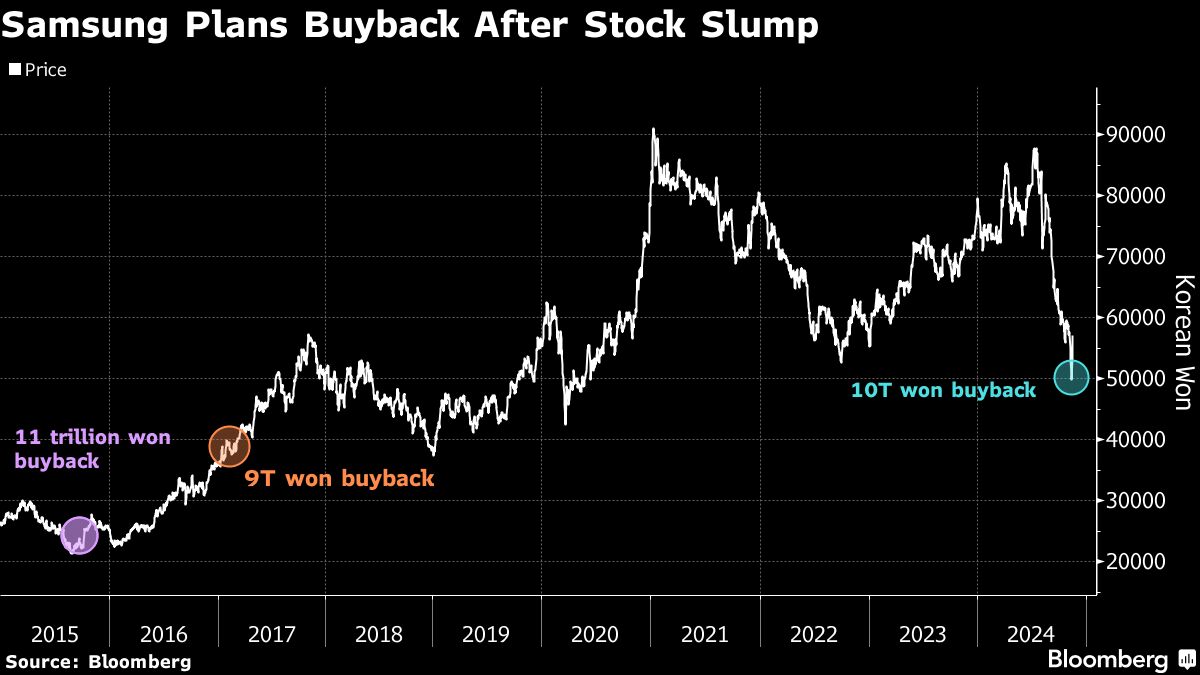

(Bloomberg) — Samsung Electronics Co. shares surged after South Korea’s biggest company announced a surprise plan to buy back about 10 trillion won ($7.2 billion) of its own stock over the next year.

Most Read from Bloomberg

The stock rose as much as 7.5% in Seoul trading Monday, adding to a 7.2% jump Friday ahead of the news. The shares are still down about 28% this year amid concerns that its memory chip business has fallen behind in the artificial intelligence market.

Analysts expect the buyback to provide a catalyst for the stock, while some noted that it may also help the founding family tighten its grip. Shares of competitor SK Hynix Inc. have climbed about 23% this year on investor enthusiasm for its AI chips.

“The sudden buyback comes as a positive surprise to us, and we believe Samsung’s management is proactively aiming to prevent further share price decline,” JPMorgan Chase & Co. analyst Jay Kwon wrote in a research note. “We believe that the restructuring and strategy/action plan to regain tech leadership will be more critical for the share price over the mid-to-long term.”

In the first phase of the plan announced Friday, Samsung will buy back about 3 trillion won of shares until February 2025, all of which it will cancel. The board will deliberate how best to deploy the remaining 7 trillion won.

Sanghyun Park of Clepsydra Capital, notes that the buyback will help the founding family strengthen its control of the company by reducing shares held externally. He also notes it may help them with collateral issues.

Members of the family have pledged group company shares as collateral for inheritance taxes on their holdings, which they are paying in installments. Some of the family have also pledged stock to borrow money from financial institutions, loans that carry risks of margin calls when the stocks fall below certain levels.

“Local desks have been buzzing since last week about Samsung potentially pulling a short-term price pop to deal with the family’s collateral squeeze,” Park wrote in a note on Smartkarma. “The stock’s probably gonna camp comfortably above the 53,000 won margin call danger zone for a while.”

Samsung is also still struggling to catch up to Taiwan Semiconductor Manufacturing Co. in outsourced chipmaking, as well as fend off tough competition in sluggish markets for smartphones and other consumer electronics. While it recently said it has made “meaningful” progress in AI memory chips, some observers think management changes are coming soon.